top of page

Getting Pre-Approved

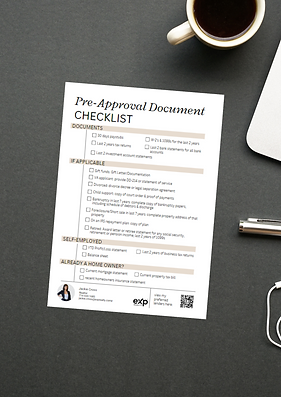

Finding out what you truly qualify for is the first concrete step in your home buying journey. To help you get started, I've listed some mortgage lenders that I recommend. Click their "APPLY HERE" link to start the pre-approval process. In addition to filling out the form(s), you will be asked to provide documentation. That usually includes:

-

2 years tax returns

-

2 months pay stubs

-

2 years w-9's and 1099's

-

2 months bank statements

-

If you have a special situation, more documentation may be needed

-

Note: The pre-approval process will require the lender to pull your credit. This will reduce your score by 2-3 points.

HERE is a list of lenders Jackie has worked with in the past and loved.

Links

Testimonial

jackie cross real estate agent - client testimonial 3

jackie cross real estate agent - client testimonial 2

jackie cross real estate agent - client testimonial 7

jackie cross real estate agent - client testimonial 3

1/8

No events at the moment

bottom of page